A deep dive into why Bitcoin represents the most precious gift in human history, and how to unwrap it wisely.

Hey everyone, Evan here.

Today’s article dives deep into a question that I think gets to the heart of what Bitcoin really represents: Why is Bitcoin Satoshi’s gift to all of us?

I’m going to break this down into three key parts:

- First, The Foundation – How Bitcoin became the engine and lifeline of the entire crypto industry

- Second, The Investment Philosophy – Facing Bitcoin after its 10,000x+ run, should we choose swing trading or long-term holding?

- Third, The Practical Strategy – As indie investors, what buy-sell strategies should we use to capture this gift?

This isn’t a prediction article. It’s a deep dive into a framework for thinking.

Let’s get into it.

Bitcoin: The Crypto World’s Super Engine

To answer this question, we need to start with a fundamental truth: Bitcoin’s price is basically the barometer and lifeline of the entire crypto industry.

Behind this reality are the three most profitable core businesses in the space: mining, exchanges, and stablecoin issuance. And all three pillars depend on Bitcoin as their super engine.

Here’s how I see this logic unfolding, and why this matters so much for every investor:

The Value Foundation

Bitcoin first took on the ultimate role of store of value in the crypto world. Because it carries massive value like a rock-solid foundation, the entire industry has a stable anchor point. This lets countless blockchain innovation experiments proceed fearlessly, even in an environment where scams run wild.

The Liquidity Engine

This massive value pool creates unparalleled liquidity. This liquidity doesn’t just serve Bitcoin itself – it spills over to fuel the speculation feast of altcoins, unleashing the market’s imagination.

The Business Catalyst

With speculation demand comes thriving exchange businesses. And to trade altcoins more efficiently, the market desperately needed a stable unit of account – which directly gave birth to and drove the early mass adoption of stablecoins.

So you see, whether it’s the rise of stablecoins, blockchain innovation, or exchange prosperity – every aspect of building around blockchain depends on the value support and liquidity nourishment provided by Bitcoin, this super black hole.

It’s the starting point of everything. And that’s what makes this gift so remarkable.

The New Fundamentals: From Individual Race to Institutional Sport

Understanding Bitcoin’s underlying value naturally brings us back to the questions we care about most.

From less than a dollar in 2010 to $100,000 today – a 10,000x+ gain.

Many people ask:

- Are we at the cycle top?

- Is it too late to buy now?

- When exactly should I sell?

To answer these questions, we need to recognize an entirely new fundamental reality.

When I say fundamentals, I don’t mean Bitcoin’s code or technology – that’s remained consistent. I’m talking about its global adoption as a decentralized value storage and exchange network, which has achieved unprecedented breakthroughs.

The Institutional Validation

With institutional entry and the approval of US spot ETFs, Bitcoin’s digital gold narrative has been completely validated by mainstream markets.

This explains why, beyond the four halving supply shocks, Bitcoin’s price can rise long-term: because its network gains broader adoption as price increases, creating a positive feedback loop.

And now, we’re at a critical turning point. Bitcoin’s competition has evolved from the early individual race to an individual + institutional + national institutional sport.

This means any future dips caused by short-term economic factors, market sentiment, or early holder selling will be absorbed by larger, longer-term strategic buying demand. Because every buyer now is in a front-running race against future Bitcoin prices.

The Mathematical Reality

Understanding this, you can see why Bitcoin can maintain high volatility while steadily crossing cycles and trending upward. So, the discussion about Bitcoin’s long-term value is basically cards on the table now.

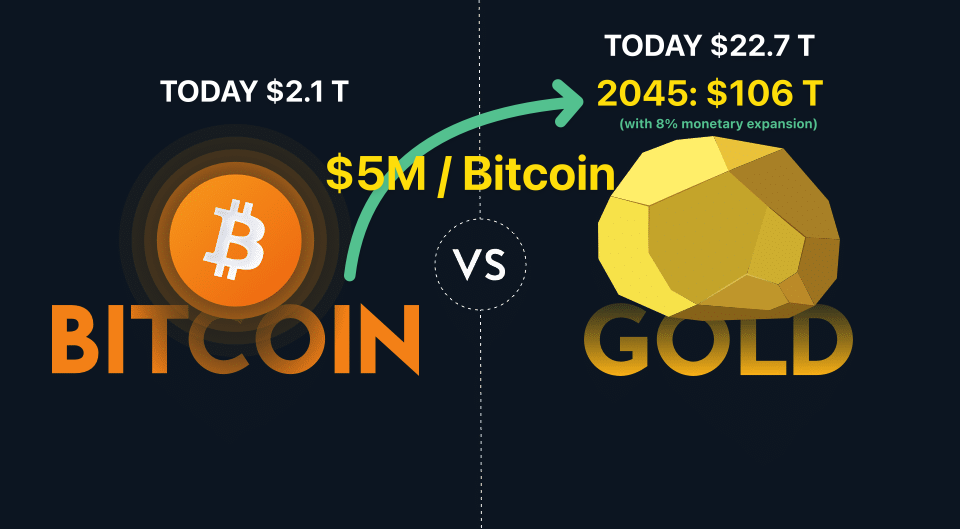

As the core value proposition of digital gold’s store of value and global transfer network, Bitcoin’s theoretical ceiling becomes much clearer when we look at the numbers:

Current Scenario:

- Gold market cap: ~$22.7 trillion

- If Bitcoin captures just gold’s current market cap: ~$1.1 million per Bitcoin

Future Scenario (20 years out):

- Factoring in ~8% annual monetary expansion by central banks

- Gold’s projected market cap: ~$106 trillion

- Bitcoin matching that: ~$5 million per Bitcoin

And that’s assuming Bitcoin only matches gold’s store-of-value function, without accounting for its superior portability, divisibility, and global transfer capabilities.

For more aggressive projections, Michael Saylor’s base case scenario suggests Bitcoin could reach $13 million per coin by 2045, factoring in broader monetary adoption beyond just store of value.

Now, I personally don’t make specific price predictions. But I do believe we are still early, and Bitcoin’s monetary experiment is far from over.

Here’s the key question: What if even a fraction of these mathematical projections prove accurate? Wouldn’t future you wish present you had allocated at least some portion of your wealth to Bitcoin today?

The Real Meaning of the Gift: Permission-less Participation

Understanding Bitcoin’s value, let’s look at those who caught the early opportunity and succeeded. Their stories help us understand what this gift really is.

Whether it’s someone like CZ, who went from tech developer to building a massive business empire through the crypto wave, or top traders like Arthur Hayes profiting massively from volatility, or those nameless ordinary people who simply believed early and held until today.

Their success paths are all different, but they all started from the same place.

The Unprecedented Opportunity

Bitcoin gave everyone a permission-less, fair entry point.

The core of this gift isn’t guaranteeing you’ll get rich. It’s guaranteeing you can participate.

No matter your:

- Background

- Circumstances

- Resources

- Geographic location

You have the right to use this global value network. This is unprecedented in human history.

Life Choice: Trade or Hold?

So facing this gift, how should we choose? Become a trader or a holder?

This is really a life choice question.

Choosing to Trade

Bitcoin’s cyclical nature and high volatility actually make it a decent instrument for swing trading. I’ve seen quite a few people successfully catch cycle swings over the past two cycles.

But this is a professional path requiring:

- Massive time and energy investment

- Extremely high psychological resilience

- Full-time job level commitment

- Constant pressure and challenges

There’s also one harsh reality: Almost everyone ends up with fewer and fewer bitcoins in their hands. There’s a saying that “you own the most Bitcoin the moment you first buy it.”

Unfortunately, I’m one of those people too. After messing around in the markets for years, I found out I would have been better off just holding Bitcoin and not moving it.

Choosing to Hold

Choosing to Hold is completely different.

The difference is you’ll realize this is capital you need to protect. You can’t expect it to generate cash flow for you. It requires:

- Ignoring short-term noise

- Embracing long-term value

- Focusing on positive work and life

This seems simple but actually tests your cognitive depth and strategic patience.

This isn’t a job. It’s more like a life philosophy that makes you a better person.

For most people, holding is the easiest and most effective way to unwrap this gift.

Practical Strategy: Buying, Holding, and Selling

Having decided on holding as the main approach, the next questions are:

- When to buy?

- How much?

- When to sell?

On Buying and Position Sizing

My strategy isn’t to predict market bottoms but to embrace volatility.

Dollar-cost averaging (DCA) with regular purchases can smooth your cost basis, making any time a reasonable time to start.

For actual DCA timing, I personally like using two indicators:

1. The Bitcoin Rainbow Chart

You can see the current price’s relationship to projected prices and what emotional range we’re in:

- Purple/Blue zones (pessimistic): Increase DCA intensity

- Green zone: Normal DCA is fine

- Orange/Red zones (FOMO/bubble): Reduce DCA intensity or stay on sidelines

2. The Bitcoin AHR999 Index

It compares Bitcoin’s current price with the 200-day average cost and long-term fitted prediction price:

- Below 0.45: Suggests undervaluation – good for increasing purchases

- 0.45 to 1.2: Reasonable valuation – suitable for regular DCA

- Above 1.2: Somewhat overvalued – consider waiting

Position Allocation

As for how much, this depends on how you position Bitcoin.

If you see it as the ballast of your investment portfolio, then a reasonable allocation of 10-30% might be appropriate.

This position’s role isn’t to make you rich overnight, but to protect your assets through future economic storms.

Here’s Bitcoin’s most unique appeal: It doesn’t require any additional operations.

- No need to stake or lock up

- No worry about project teams running away

- Just hold it carefully in a secure wallet

- Security protected by the world’s most powerful hash rate network

On Selling Timing

While we choose long-term holding, investment’s ultimate purpose is returns – real money in your pocket, not paper numbers.

Rather than guessing at a non-existent top, focus on three rational sell signals:

Signal One: Disciplined Selling – Dynamic Rebalancing

When Bitcoin’s proportion in your total assets becomes too high (say from 20% to 80%), and your overall portfolio has moved up a level but the volatility makes you uncomfortable – consider adjusting it back to your comfortable target proportion.

This isn’t about prediction. It’s pure position management.

Signal Two: Goal-oriented Selling – Realizing Life Value

When your life needs this money to start a new chapter. Investment’s endpoint is better living.

When you’ve found the house, have a mature business plan, or need to supplement retirement funds, Bitcoin is your reliable financial backup that you can access anytime.

Signal Three: Opportunistic Selling – Finding Better Alpha

But be extremely careful here.

When you’re convinced you’ve found a better investment opportunity.

⚠️ SERIOUS WARNING: Bitcoin itself might be one of the biggest Alphas of our time. Before moving funds away from it, you must calmly ask yourself:

- Does this new opportunity really have confidence to outperform Bitcoin over the next few years?

- Have you fully considered the opportunity cost of missing Bitcoin’s subsequent growth?

The Foundation of Success: Cash Flow

Finally, I want to re-emphasize the bedrock supporting all these strategies: Consistent, stable off-market cash flow.

Strong earning ability is your biggest guarantee for:

- Holding with composure

- Having confidence to execute discipline

- Not being forced to sell during market lows due to life pressures

Cash flow is always your biggest trump card at the investment table.

Conclusion: The Most Precious Gift

So, let’s return to the original question: Why is Bitcoin a gift?

Because it’s not just a speculative asset.

It can become:

- Each person’s life retirement plan

- The backup for all your investments

- The ballast of your entire asset allocation

In a world full of uncertainty, it provides you with consistent, clear certainty that no one can manipulate.

This is the most precious gift Satoshi left us.

Have fun, stay SAFE, and always Do Your Own Research.

Join me to navigate the markets and aim for success together!

About the Author: Evan is an independent investor focusing on US tech stocks, A-share growth stocks, and Bitcoin accumulation. He provides practical investment insights and market analysis for middle-aged investors through a navigator’s perspective – offering frameworks for thinking rather than predictions.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Always do your own research and consult with qualified financial advisors before making investment decisions.